Although the global market affords a great opportunity for first-year traders to operate, it is still hard to realize a profit, which can annoyingly lead to the trader backing off.

This market complexity has led many first-year traders to consider quitting or taking a long break. If you’re on the verge of hibernating to escape trading activities, this guide is for you.

Why do first-year traders choose to hibernate?

To understand why first-year traders give up on trading and choose to become inactive for a period, we must examine why this feeling pops up. It is usually due to different reasons.

Firstly, when a first-year trader is not making profitable trade, there’s a high tendency to become dormant after a while. Secondly, there’s a profit level, but it needs to meet the trader’s needs. First-year traders may opt out of the market and break from trading activities in both scenarios.

5 disadvantages of hibernating in your first trading year

Now that the cause has been identified let us look at the drawbacks of hibernating.

1. You will miss out on an important trading experience

Every loss you may encounter in your first trading year should be considered your stepping stone to learning important trading lessons. The moment you exit a trade after encountering a loss, you should take time to examine why that is the case and avoid making the same mistake next time.

The best way to approach this is to trade with a journal. In your journal, you write trading details to help you learn from your errors. Each time you resort to hibernating as a first-year trader, you deny yourself the benefit of learning one of her greatest trading lessons.

2. You would cultivate a bad trading habit that could be difficult to overcome

Continuous hibernation can lead to the cultivation of bad habits such as paying less attention to details.

Before you think of hibernating and taking your hands off trading, you should reconsider what you will be missing out on in terms of trading details and experience. Usually, after experiencing a series of unfavorable trading, it is normal to avoid repeating the event.

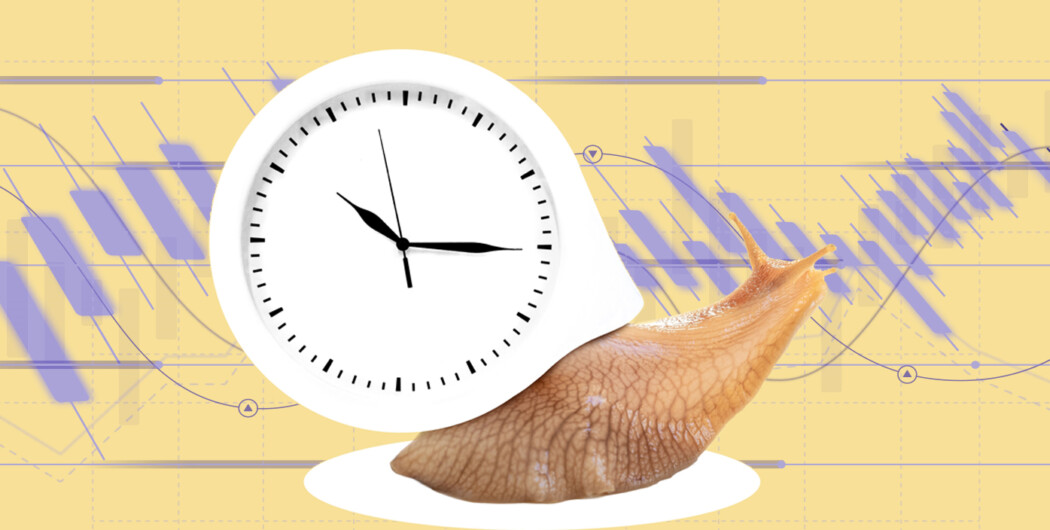

In doing so, you will pay more attention to your decisions and strategies. A good example is to learn how to set a stop-loss to prevent further exposure to your portfolio. This is one detail that is almost always overlooked.

Chart showing the addition of a stop loss to mitigate bankruptcy and further trading frustration

“Hibernating in your first year will shift your focus away from important integrations like stop loss setting”

— Victor Piérre, trade analyst, Gebion Inc.

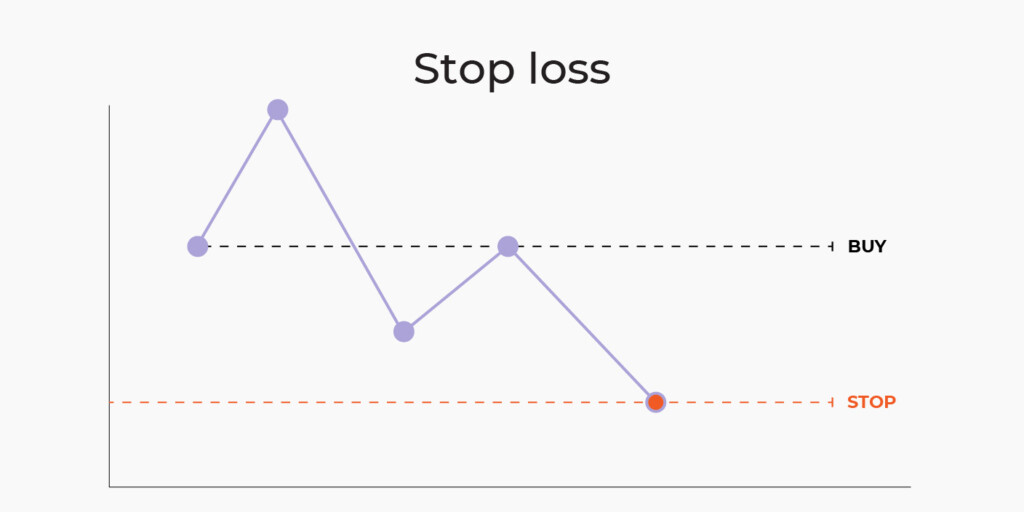

3. Missed trading opportunities

It would be best to take advantage of potential trading opportunities when you give up and choose to go dormant as a trader, as you must have realized by now that there are so many trading opportunities in the global market that you can partake of. You can profit regardless of the direction of the market.

Chart showing possible missed opportunity in an uptrend due to pulling out of the market

“Always keep in mind that quitting trading in your first trading year can affect you negatively. It is great to be consistent”

— Emre Aydin, SNR trade indicator consultant and analyst.

4. Continuous waste of efforts

Another reason you should not consider hibernating as an option is that you would have no reward for your past efforts. Speculating the global market takes a lot of time and learning to master. You will have wasted all your energy when you give up due to a few losses. Instead, consider analyzing your strategies when the need arises.

5. You can never gain mastery

Mediocrity thrives when a trader continues to move away from unfavorable trading experiences. Think of it as a sailor who needs to weather through the different conditions to become a pro. Instead of running away from the boisterous market condition, keep your focus sharp and work your way towards mastery.

Conclusion

To wrap it up, there are better options than hibernating in your first trading year when you face a roadblock. The global market is not easy to conquer, but it is worth staying with. Understand how to profit from your trades and limit the possibility of walking away whenever tough times arise.