Risk management failures are often depicted as the result of unfortunate events. But in reality, many risks are due to systemic problems that could have been addressed proactively.

For example, look at the infamous Texas winter blackouts in 2021. Operators knew about the risks of a major snow and ice storm, but the state did nothing proactively. It turned out to be the costliest winter event in U.S. history.

These real-life examples of risk management failures should teach us a lesson – be proactive. Here is what it means for traders.

1. Calculate your maximum drawdown level

Consider this: a trader had $100,000 in their account and lost $50,000. The percentage of their account lost is 50%, which is a drawdown. And the maximum drawdown level indicates the highest risk you can take over a specified time period.

Figure out this percentage for you personally to know when you should exit the market in case of a “losing streak.”

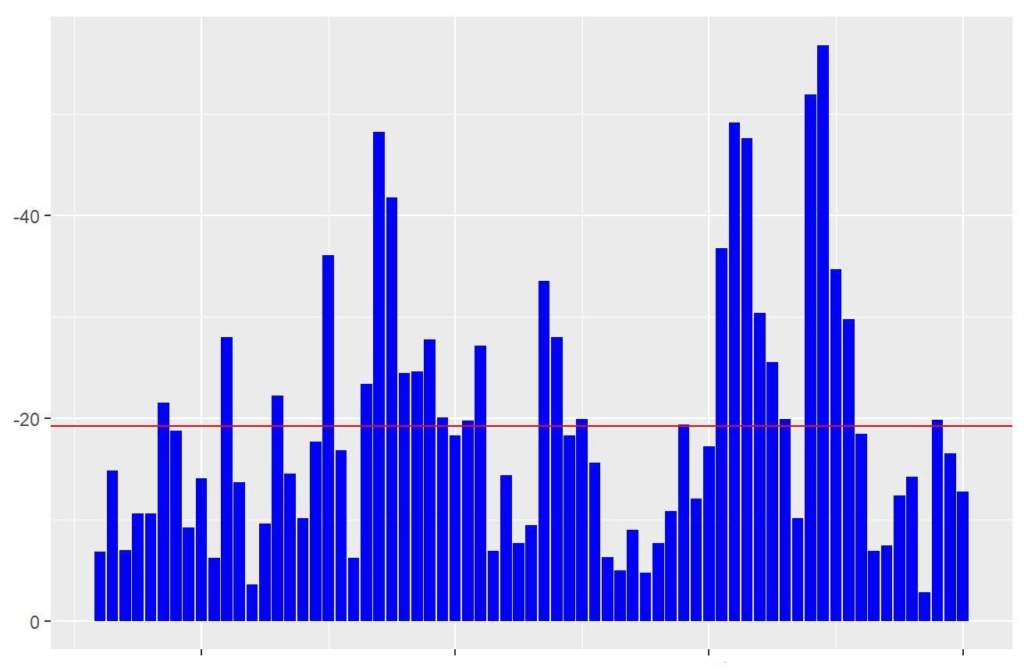

2. Try out different trade specifications

A set of trade specifications will carry different amounts of risk depending on the asset, current market, time of the trade, and other factors. The secret to a consistent level of risk is to adjust the settings. This means setting up different levels of stop loss, correcting your trade sizes, choosing different types of orders, etc.

3. Make trades at certain periods

There is no “best time” to trade anything. But you may be able to find your personal best time to make trades. For example, you may find that you enter the poorest currency trades when the volatility is high. So, you can limit your activity when two trading sessions overlap.

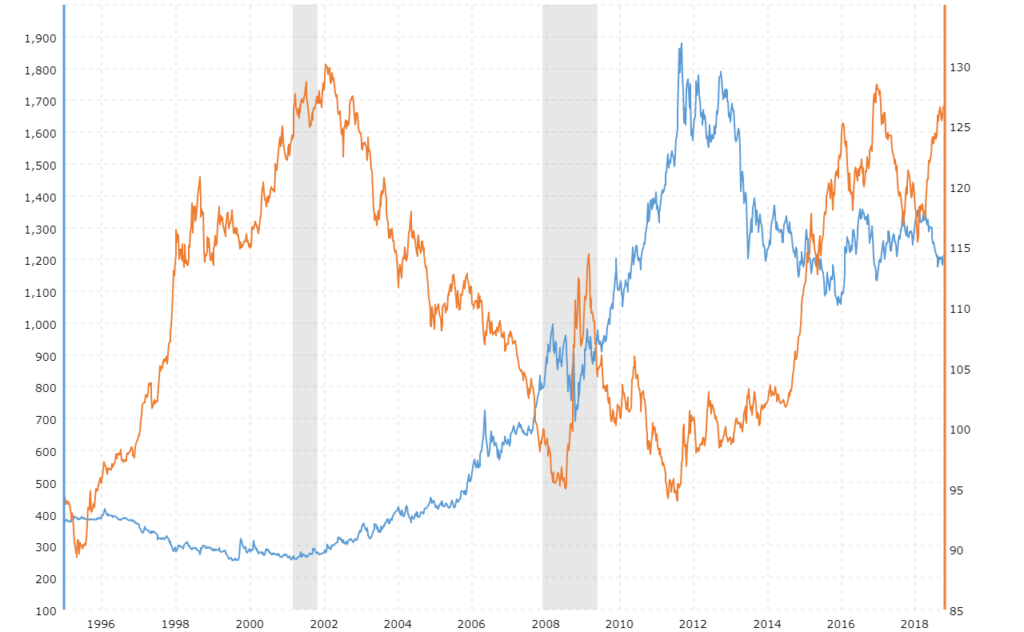

4. Trade unrelated instruments

The imperfect correlation between your assets will ensure that a crash in one market will not bring down your entire account. Here are some of the pairs that have a low (or insignificant) effect on each other’s prices:

- Commodities – bonds

- Managed funds – currencies

- Crypto – real estate

Look up asset correlation maps for more ideas.

5. Have self-imposed rules

When there is a big price swing, you may be tempted to allocate a large chunk of your funds to a potential trade. But you already know that it will put you at risk of losing a lot of capital, too. To avoid the temptation, some traders religiously follow the self-imposed “1%” or “2%” rule. Come up with your own rules to keep you from making impulse decisions.

Bringing risk management basics and secrets together

All too often, people rush to adopt new or secret techniques just because they are new or secret. Rather than jumping on any technique, analyze whether it’ll actually be useful and how well it fits into your strategy. Consider its implications in the short and long term.

If you choose to use any of the risk management secrets shared in the article, remember about the basics, too. You’ve probably heard or read about recommendations to plan your trades, set a stop loss for every trade, and size your positions based on your risk tolerance. Remember to apply them first and only reach out for the secrets after. If you haven’t heard or read about the basics yet, it may be better to start there.