Many people are already fantasizing about their winter vacations and Christmas gifts. However, the markets will remain open until Christmas.

Investors and traders have wondered whether they should trade over the holidays. Unfortunately, holiday trading is a divisive topic among traders even when conditions are favorable.

This year’s unusually long Christmas season may cause investors to rethink their trading plans. We recommend the following strategy to make the most of this moment of opportunity.

1. Get a grasp of the past before strategizing

During the busy Christmas shopping season, specific trades do much better than others. Therefore, examine the stock’s performance throughout the last five years between the dates of the end of November and the beginning of December.

Remember, to avoid making generalizations dependent on the market’s overall success; you will need to compare the market performance to that of its contemporaries or the S&P 500 over the same period.

2. Anticipate high standards

What kind of performance does Wall Street anticipate from the firm while it is on Christmas break? Is there a lot of excitement about the firm, or are there worries that their products won’t be successful in the market?

In any case, it is critical to record these prerequisites and requirements. Throughout the holiday shopping season, they will supply the default narrative, which will provide a chance to significantly outperform or underperform the projections made by analysts.

3. Develop your markets knowledge

Consider it an opportunity for continuous learning even before the holiday season. Traders constantly need to keep their minds on acquiring new knowledge.

It is essential to remember that understanding the markets and their complexities is a process that continues throughout one’s life.

Conducting an in-depth study allows traders to comprehend the data, such as the significance of the various economic reports. Traders may hone their senses and pick up on subtleties by focusing on the details and observing the market.

The markets are sensitive to various factors, including global politics and news events, economic developments, and weather. As a result, the atmosphere of the market is quite dynamic. When traders have a deeper understanding of historical and contemporary markets, they can better plan for the future.

4. Risk only what you can afford

Verify that all the funds on that trading account are disposable before using real money. If it isn’t, the trader has to continue putting money aside until it is.

Even when the holiday season is over, funds in a trading account should be used for something other than things like paying off the house or sending the kids to college. Traders must never assume that they have access to funds that might be used for meeting these other responsibilities.

The stress of losing money may be overwhelming. However, it is even more problematic if the money should never have been at stake.

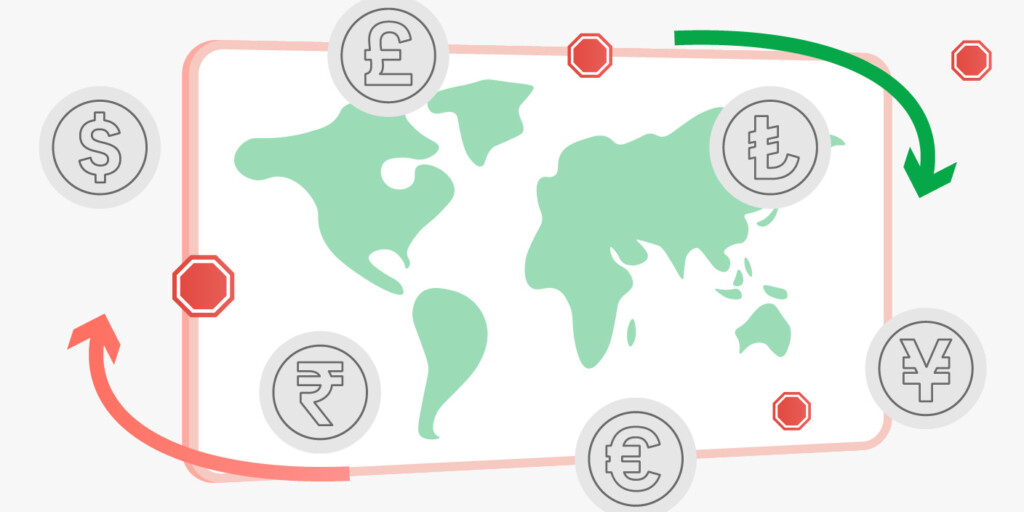

5. Utilize stop loss and currency pairing

Since market volatility often decreases over the holiday season, it is prudent to revise your stop loss and take profit levels accordingly.

With volatility on the EUR/USD dropping by about a quarter of its average, a trade setting that would have ordinarily returned 100 pips may now be more effectively targeted at 70 to 80 pips.

You must also take note of the following:

—Predefined level setting

A trader’s stop loss is the predefined level of risk they are prepared to take on each deal. Traders restrict their risk by setting a stop loss, expressed as a fixed monetary sum or a percentage of the trade’s total value.

—Gauge phase level setting

Not having a gauge phase stop loss is a terrible practice, even if it results in a profitable transaction. On the other hand, stop-loss trading, which results in a lost transaction but still adheres to the trading plan’s guidelines, is considered excellent trading.

—Exiting level setting

Exiting every transaction with a profit is ideal, but it only happens in practice sometimes. Losses and hazards may be mitigated with a protective stop loss.

Final thoughts

If a trader wants to develop a successful trading firm, it is in their best interest to comprehend the significance of each of these trading principles and how they connect.

Trading is challenging work, but those who are self-disciplined and patient enough to follow these guidelines have a better chance of success in a market fraught with intense competition.