There are all sorts of weird crypto stories from last year. A “comedic rapper” was charged over the Bitfinex hack, actor Seth Green’s Bored Ape Yacht Club NFTs were stolen.

On the whole, 2022 was a challenging year for the cryptocurrency market, with many coins experiencing significant price declines. However, experts believe that certain factors may help to turn the situation around for the cryptocurrency market in the future. Here are some of them:

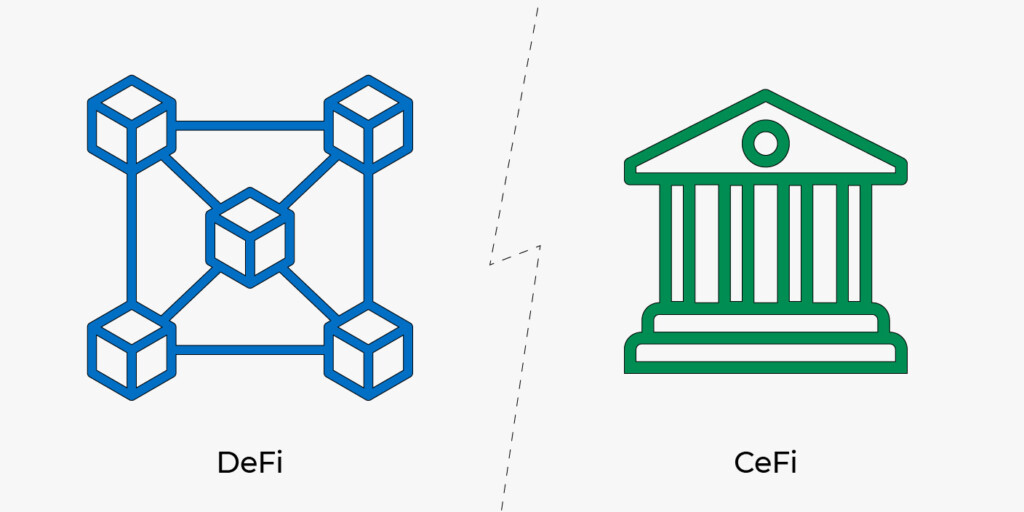

CeFi-DeFi

CeFi and DeFi systems can affect the movement of crypto in different ways. CeFi can open new opportunities for investors and drive demand for digital assets, while DeFi can drive demand for specific cryptocurrencies and contribute to the growth of the crypto market as a whole.

It begs the question, “what will Ethereum be worth in 2023 since it’s so closely linked to DeFi?”. If DeFi grows, so will Ethereum, perhaps surpassing the $2,000 or even $2,500 mark.

Regulations

Policymakers and regulators are considering new laws following the collapse of FTX, which will definitely affect the 2023 crypto. For instance, the governor of the Bank of England believes crypto has to “meet standards equivalent to those expected of commercial bank money.”

Also, The Markets in Crypto-Assets (MiCA) regulation will be “one of the first attempts globally at comprehensive regulation of cryptocurrency markets.”

Altcoin security

If an altcoin is perceived as secure, it may be more attractive to investors and traders, leading to an increase in its price. Plus, if an altcoin successfully withstands a security attack or implements new security measures, it can lead to an increase in confidence in the coin, as well as the cryptocurrency market in general.

Participation of large corporations

Which cryptocurrency will rise in 2023? The one that corporations will choose. When large corporations invest in or adopt cryptocurrencies, it can increase demand for those assets and drive up their prices. Even announcing the plans to use or accept cryptocurrencies can be impactful.

Bitcoin halving

Yves Reno, head of trading for a cryptocurrency card payments firm, said, “The next bitcoin halving might pull the industry out of the muck”.

The effect of halving the price of Bitcoin is a subject of much debate in the crypto community. But it is generally agreed that the supply of new bitcoins entering the market will decrease because of lower rewards. In turn, it may drive up the price of the existing coins.

What will Bitcoin be worth in 2023 if it halves? Predictions range from $250,000 all the way down to $5,000.

Technological advancements

Advamanceme in smart contract functionality, scalability, privacy, and more could have a positive impact on the movement of cryptocurrencies. One example is Ethereum, which is working on upgrading its network to a more energy-efficient way of mining called Proof-of-Stake (PoS). This would decrease energy consumption and make it more sustainable.

Conclusion

2022 has brought attention to the industry’s flaws, and now 2023 has to mend them. Investors are hoping that these six factors will have positive impacts on the prices of digital currencies, but they have to be ready for negative impacts, too.

In addition to emerging themes to watch out for, you may also be interested in some predictions. According to John Divine, senior financial markets editor for U.S. News & World Report, these are the best cryptocurrencies to invest in 2023:

- Bitcoin (BTC)

- Ether (ETH)

- Avalanche (AVAX)

- Polygon (MATIC)

- Cardano (ADA)

- Cosmos (ATOM)

Obviously, it’s hard to be precise about cryptocurrencies that will explode in 2023, or any other year for that matter. So make sure to do your own research and follow risk management practices just in case.

Sources:

DeFi vs. CeFi: Comparing decentralized to centralized finance, Cointelegraph

2023: The year of regulation vs. decentralization, CoinDesk

Experts predict crypto will come with regulation, DeFi, rebuilding, Fintech Nexus

6 of the best cryptocurrencies to buy now, U.S. News – Money