It’s a popular delusion that a smooth balance chart means successful trading. In reality, it means that the trader does not use stop losses but waits for each trade to close with profit. In this case, the risk of losing funds is near 100%.

To avoid such a scenario, let’s look at certain principles of proper money management in Forex trading to protect your capital.

1. Always adhere to the chosen strategy

Trading paths are full of traps, and inexperienced traders often fall into them. That’s why you should always strictly adhere to the chosen strategy to minimize your risks. Here are some common strategy-related traps:

- A transaction promises high returns, but it does not fit into the strategy.

- Your strategy does not give a signal to open a trade, but your intuition does.

There are numerous Forex money management strategies to consider. It’s best to think of them as an algorithm that will drive a positive outcome if you abide by its rules. However, mixing different strategies when opening a trade is a bad practice. That’s true regardless of what money management is in forex in your personal case.

2. Try to avoid Forex trading on minutes

Scalping in the Forex market often leads to losses. This strategy is popular on stock exchanges—but in Forex, a trader is not able to move the dealer’s prices. Therefore classic scalping doesn’t work in Forex properly.

The majority of potentially successful Forex strategies are based on technical analysis that works on longer timeframes. Although the price behavior tends to repeat, there are no guarantees it eventually will. That’s why you can never be 100% sure it’ll be profitable.

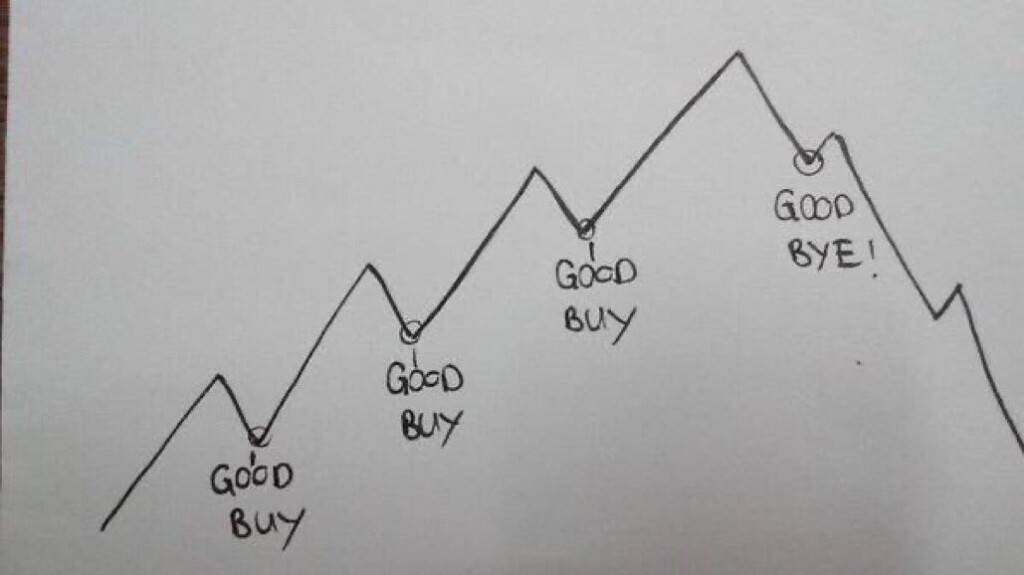

3. The trend is your friend

Trend trading is a Forex classic. The probability of keeping the price in the trend range is higher than the exit from it or the trend reversal. For example, one of the good money management techniques in forex trading is to:

- Place a buy limit some points higher than the support line

- Place a stop-loss just below it

- Place a take-profit a bit lower than the resistance line.

This is especially true for charts with larger time intervals.

4. Close any deal before important news

Sooner or later the price breaks out of the established channel. Such cases include the release of particularly important news. That is why one of the proven money management tips for forex traders is to close trades in anticipation of important press-releases. The exception is a small group of strategies based specifically on the news.

Along with important news, there are some more situations in which it is better not to trade. One example is the run-up to the holidays: there can be sharp price fluctuations in the market. Inexperienced traders are usually not ready for this because the market does not behave normally.

Nial Fuller says: “Trading the news is like a black hole of distractions.”

5. A trailing stop may be a good choice

One more case of extreme trading is high volatility in the thin market before the holidays. Trailing stops would be an excellent tool for such cases. After all, a human trader typically cannot move orders as quickly as a computer. However, keep in mind that news trading is a technique for professionals who know what they are doing.

6. Keep a log for planning and analyzing your trades

As soon as losses occur, conclusions must be drawn from them—especially considering that the market tends to change with time when old patterns stop working. Even experienced traders are advised to keep a log of completed deals. Consider it your own knowledge base of how to use money management in forex trading. Within the log, a trader can set a plan for future deals, analyze the reasons for losses, and make changes to the trading strategy. Still, you shouldn’t modify your strategy on the go until there’s strong evidence of its failure.

7. Take a break after a series of losing trades

The reason for staying off the market may be a series of losing trades. By the way, if this happens, another principle of money management in Forex trading comes into force: limit losses that are allowed within a certain time (day, week, etc.) A trader needs to take a break from trading and thoroughly analyze the market. Otherwise, trading risks can turn into health risks, which is much worse.

Conclusion

As you see, proper money management in Forex trading is not only about numbers. It is also a way of thinking. A good trader always tries to avoid risky deals. Save your capital first while your strategy does the rest.

Sources:

Tips for Forex Trading Beginners, Forex.com

9 Forex Trading Tips, Investopedia