Elasticity and inelasticity of demand in economics are the degrees to which demand changes in response to changes in prices, income levels, and substitution. It seems complicated, but it’s not. Let’s figure out what elastic and inelastic demand are, how they are measured, and why they are important for businesses and consumers.

Types of demand

Demand can be categorized into five different types:

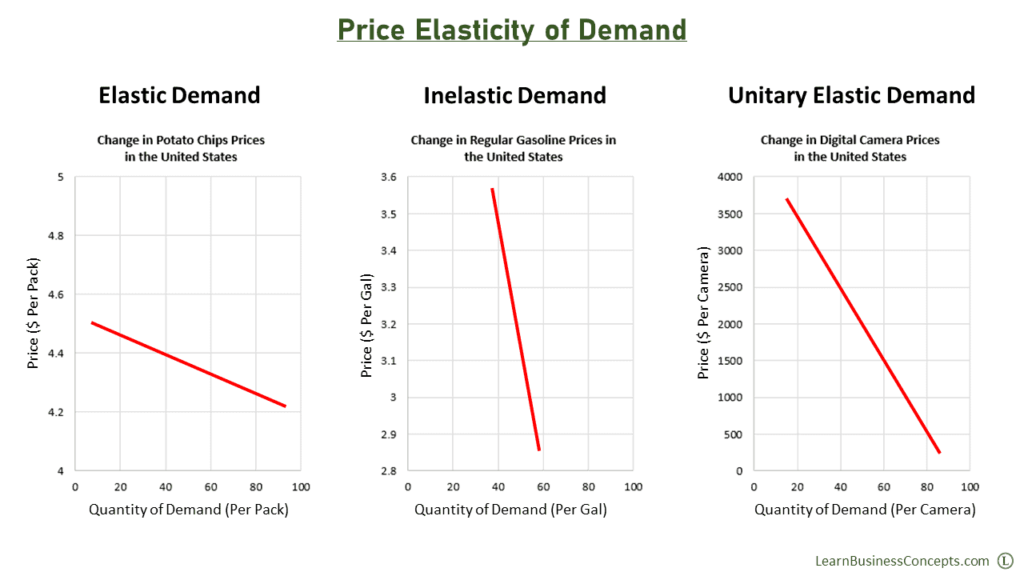

- Elastic – A demand is considered elastic when there is a huge change in the quantity of demand caused by a price change.

- Perfectly elastic – A demand is considered perfectly elastic when the price of a good or service can lead to the quantity of demand to fall to zero. When a perfectly elastic demand is experienced, any reduction in price will not lead to an increase in sales.

- Inelastic – A demand is considered inelastic when there are minimal changes in the quantity of demand in relation to changes in prices.

- Perfectly inelastic – A perfectly inelastic demand, on the other hand, means that no change in the quantity of demand occurs despite changes in prices.

- Unitary – A demand is considered unitary elastic when changes in prices lead to a balanced ratio between price change and quantity demanded, or when the percentage change of quantity demanded is the same as the percentage change of the price. A typical example of unitary elastic demand is electronic goods: household appliances, mobile phones, and other gadgets.

Overall, elastic, unitary, inelastic, perfectly elastic and perfectly inelastic demands measure the response or sensitivity of demand to changes in economic factors.

Meaning of elasticity and inelasticity of demand

In economics, the terms “elasticity” and “inelasticity” refer to how responsive consumers are to changes in price. But what do you mean by the elasticity of demand? If there is something else, let’s take a closer look at the topic.

The definition of elasticity demand says that demand is elastic if the demand for a good or service changes when the price changes. It can also help to determine how much revenue a firm can generate by increasing prices.

Let us first explain the price elasticity of demand. If the demand for a good is price elastic, a price increase will lead to a decrease in revenue. Conversely, if demand is inelastic, a price increase will increase income. This relationship between price and income is known as “price elasticity of demand”.

Examples of elasticity and inelasticity of demand

Examples of goods with elastic demand are certain foods, drinks, and luxury goods since changes in their prices affect demand.

Examples of goods with inelastic demand are tobacco and prescription drugs, as demand often remains constant despite price changes.

Generally, companies prefer to sell goods with inelastic demand because they can generate more revenue by increasing prices. However, they must be careful not to raise prices too much, as this can decrease demand (and hence, income).

What is the elasticity of demand?

Let’s explore the concept of elasticity of demand, and it’s important for the market. If demand for a good is price elastic, then consumers will purchase less of the good when prices increase. On the other hand, if demand for a good is inelastic, then consumers will continue to purchase the same quantity of the good even when prices increase.

Some factors can influence the elasticity of demand for a good, including the availability of close substitutes. Typically, products with close substitutes will be more elastic because consumers can easily switch to another product if prices rise. On the other hand, essentials will be inelastic as consumers have no choice but to keep buying the goods even if prices rise.

What is the inelasticity of demand?

The term “inelasticity of demand” refers to how unresponsive consumers are to changes in price. If demand for a good is inelastic, then consumers will continue to purchase the same quantity of the good even when prices increase.

An example of inelastic demand would be if the price of gasoline doubled, but people still had to commute to work, so they would continue to purchase the same amount of gas as before. Gasoline would be considered an inelastic good.

What are the 4 types of elasticity?

There are four main types of elasticity of demand: price, cross, income, and advertising. They are based on a change in the price of a product, a change in the price of a similar product, a change in revenue, and a change in advertising spending, respectively.

Let’s analyze the most popular.

Cross elasticity of demand

The cross-elasticity of demand measures how responsive consumers are to changes in the price of another good. It is calculated as the percentage change in quantity demanded of one good in response to a 1% change in the price of another good.

Generally, goods are considered substitutes if they have a positive cross elasticity of demand (i.e., an increase in the price of one good lead to an increase in the demand for the other good).

Goods are considered complements if they have a negative cross elasticity of demand (i.e., an increase in the price of one good lead to a decrease in the demand for the other good).

For example, if the price of good A increases by 1% and the quantity demanded of good B decreases by 2%, then the cross elasticity of demand between goods A and B is -2%. This means that goods A and B are substitutes.

Advertising elasticity of demand

The advertising elasticity of demand measures how responsive consumers are to changes in advertising. It is calculated as the percentage change in quantity demanded divided by the percentage change in advertising.

If the advertising elasticity of demand is greater than one, then an increase in advertising will lead to an increase in demand. If the advertising elasticity of demand is less than one, then an increase in advertising will lead to a decrease in demand. If the advertising elasticity of demand is equal to one, then changes in advertising will not affect demand.

Advertising elasticity of demand can be used to measure the effectiveness of different advertising types and make decisions about where to allocate advertising budgets. It can also be used to assess the potential impact of regulations on advertising.

Meaning the price elasticity of demand

Economists use several different methods to measure the elasticity of demand. The most common measure of elasticity is “price elasticity of demand”. It is the ratio of the percentage change in quantity demanded to the percentage change in price.

The measurement of elasticity of demand is shown in the formula:

PEd = %Change in Qty / %Change in Price

If the quotient is greater than or equal to one, demand is elastic; if less, then inelastic.

Note! The price elasticity of demand can range between zero and infinity. The closer to infinity, the more elastic demand.

What does a price elasticity of 1.5 mean?

According to our formula, if the price elasticity is 1.5, this means that the demand for the product increased by 15% when the price decreased by 10% (15% / 10% = 1.5).

Elasticity and total revenue

As defined, the elasticity of demand directly impacts the total income of companies and depends on price jumps for goods. That is, it occurs when demand responds to a change in price or other factors. Conversely, elasticity means that demand remains constant even when price or other factors change.

We always talk about elastic demand if consumers have many options for goods and services. However, goods and services for which consumers have few alternatives are most often inelastic.