There has been much talk about the attack area of quantitative trading, like mean reversion, ML, and momentum. These trading strategies are targeted to outperform the index or benchmark by adding your perspective to existing trading strategies.

Professional traders believe that a good way to defend is to have an equally good offense strategy. What, then, does defense mean within the confines of quantitative trading? Can it be synonymous with ensuring that money is lost during the trade, doing nothing technical along the line?

Discussing the Kamikaze Portfolio strategy (KPS) would shed some light on the true essence of defense in trading.

What does it mean to defend in trading?

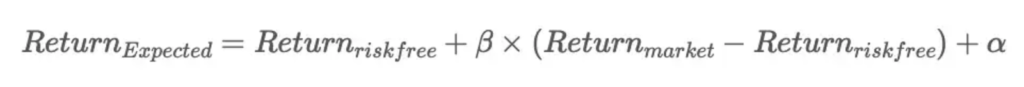

When speaking of quantitative trading strategy, it all boils down to using advanced formulas like CAMP. The use of such formulas is to categorize trading strategies based on their differences quickly.

In the formula displayed below, β represents the level of sensitivity that a trader’s portfolio has against the movement of the market return. “α” in the formula represents the extra market return that the β term cannot handle.

Take, for example, if the present rate of risk-free is at 1%, and the return of the market is at 4%, having 0 in α, then the expected return can be calculated as follows:

2*(4%-1%)+1% = 7% (if the β equals 2), or 10% if the β equals 3.

The β represents your portfolio’s exposure against inevitable fluctuations in the market. The general idea of going on the defensive side during trading is to ensure a reduction in the direction (i.e., β) against instability in the market.

This is so that traders will retain more money when there is a bearish trend in the market. There are other effective ways for traders to ensure that their portfolio is less exposed to unfavorable market conditions. Strategies such as market-neutral, hedging, and portfolio diversification, among many others, are ways to trade with extreme caution and reduce your portfolio β.

An important side note to always keep in mind in a defensive trade that involves reducing portfolio exposure (β) is that this can also affect profit when the market rallies upward. This is one of the effects of trading defense.

The concept of KPS defense strategy (Kamikaze Portfolio Strategy)

The Kamikaze portfolio strategy (KPS) is a way for traders to reduce exposure to risk. An excellent way to go about this is to include a risk-free asset into the portfolio (this may be a three or 4-month treasury), a kind of portfolio diversification.

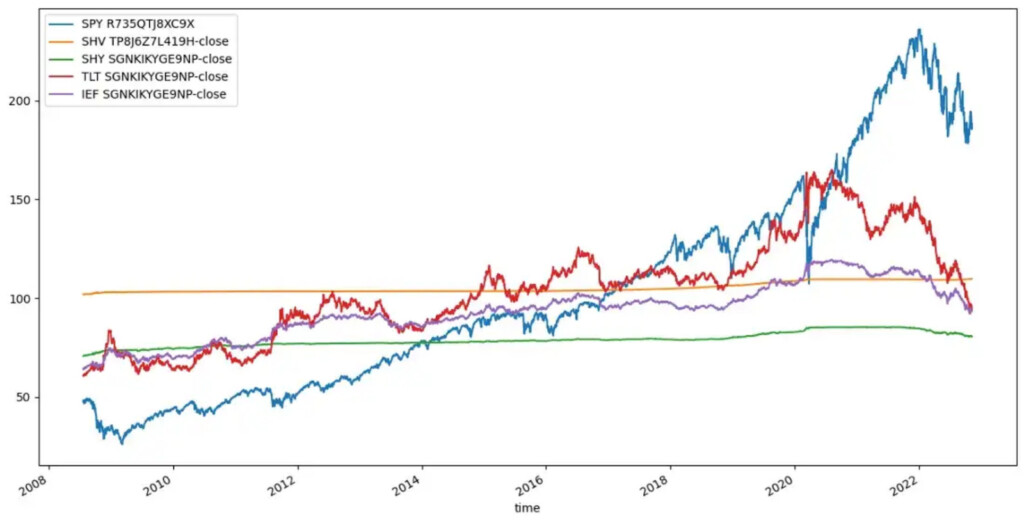

Generally, short-term assets have lower risk exposure than others’ long termed treasuring against the market. It can be seen below that the relative price movement of SHY, SHV, IEF, and TLT are close when compared to that of SPY.

In addition to including a risk-free asset, the Kamikaze portfolio strategy (KPS) trading proposes Cushion and Floor concepts. The cushion is a term that explains the asset value a trader would like to invest in risky assets to have added return.

On the other hand, the floor is the lowest asset value that a trader seeks to protect from suffering loss.

The disadvantage of the KPS defense trading strategy

Below is a significant con to applying the Kamikaze portfolio strategy (KPS) when trading.

The floor level remains fixed, even if the overall asset value launches high. If, for instance, a trader approaches this trading strategy with a fixed percentage of 70% of the asset to be protected, it implies that $70,000 will be the floor level in an investment of $100,000

Recommendation

The KPS trading strategy is an effective way to play defense, and it allows traders and investors to retain their potential chances of making successful trades while limiting risks. The floor and cushion ratios can be scaled dynamically to ensure no collaterals.