Here is an inspiring story about mental toughness: overcoming polio and physical challenges, American sprinter Wilma Rudolph became an Olympic champion, winning three gold medals in the 1960 Olympics in Rome. Through sheer perseverance and countless hours of hard work, she refused to let her circumstances define her. If Wilma Rudolph could use her mindset and determination to reach her full potential, so can you.

Whether it’s staying confident during volatile periods or staying disciplined in executing trading strategies, you need mental toughness to navigate the complexities of fixed time trading. And this article shares a few tips to cultivate it.

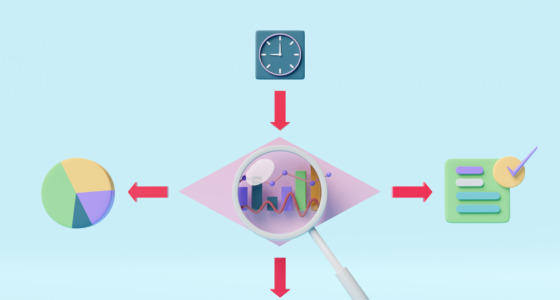

What is fixed time trading?

Fixed time trading, or FTT, is the practice where traders make forecasts on the price movement of different assets within a predetermined time period. They speculate whether the price will go up or down during that specific period. If the prediction is correct at the end of the period, traders earn a profit (usually, a fixed percentage of their initial investment). However, if their prediction is incorrect, they may lose some or all of their investment.

As mentioned, FTT can be a challenging and unpredictable trading practice that requires a high level of mental toughness. And you’ll be better equipped to thrive in this dynamic world by following these tips:

Tip #1: Know when to say no

In the fast-paced world of trading, it can be tempting to constantly engage in trades and seize every opportunity that comes your way. However, it’s essential for FTT traders to recognize that not all trades are equal. Sometimes, saying no to certain opportunities is just as important as saying yes.

Here are a few key points to consider before saying yes or no:

- Strategy alignment

- Risk management

- Emotional discipline

- Market conditions

- Time and energy management

Tip #2: Follow through your plans

When you have a well-defined plan, it signifies that you have put careful thought into your strategy. And when you follow through on your fixed time trading strategy, it builds discipline and consistency in your approach. It instills a sense of responsibility and professionalism, demonstrating that you take your craft seriously.

Tip #3: Streamline your environment

Your trading environment greatly influences your mindset, productivity, and ability to focus. If you agree, try this:

- Start by organizing your physical workspace. Keep your workspace clean, tidy, and free from unnecessary distractions.

- Consider using noise-canceling headphones or finding a quiet location where you can concentrate without disruptions.

- Configure alerts for specific price levels, technical indicators, or news events that align with your trading strategy to avoid constant monitoring.

- Ensure that your trading platform, charting tools, and other software are up to date and functioning smoothly.

- Develop rituals and routines that signal the start and end of your trading sessions.

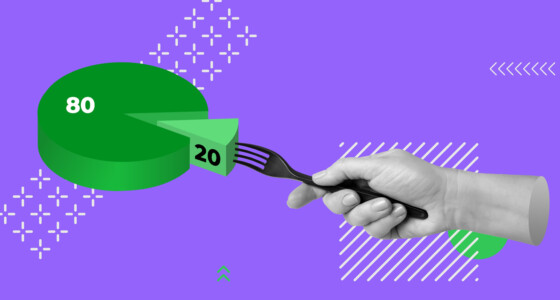

Tip #4: Play to your strengths

When you trade in areas where you have a comparative advantage, you’re more likely to have a clear understanding of the market dynamics. This makes you better primed for well-reasoned choices with conviction. As you start to see results, the successful trades and outcomes will reinforce your confidence and validate your trading strategy.

This positive feedback loop tends to enhance a person’s self-belief and motivates them to continue honing their skills.

Tip #5: Expand your skill set

With the previous point in mind, there is one correction to make: everyone has limitations. Plus, you don’t want to skip on the value of continuous learning and growth.

Expanding your skill set allows you to explore new opportunities and potentially discover untapped areas of expertise. You will become a more well-rounded trader, capable of adapting to different market conditions and asset classes. What better way is there to build confidence and discipline if not through continuous growth as a pro?

How to trade fixed time

When it comes to FT, the process is not fundamentally different from other forms of trading. Many of the core principles and strategies remain the same. Traders choose an asset, such as stocks, currencies, or commodities, and decide whether the price will rise or fall during that set period. The decision will be based on market analysis, trading strategy, and risk management.

In conclusion, while it poses its own challenges, cultivating inner strength is essential to thrive in this landscape. Hopefully, the tips shared in this article will serve as a valuable guide to help traders develop and strengthen their mental fortitude.

Sources:

5 strategies to boost your trading confidence, Capital

Trading with confidence – 5 powerful tips, Tradeciety