An upward movement of prices for essential goods and services has been witnessed of late globally, called inflation. Why is this happening, and is there any hope that the situation will improve? In this article, we will review the causes of inflation, its types, and the possible measures to control it.

What is inflation?

The simplest meaning of inflation in English is a general increment or an upward rise in the prices of goods and services. As the general price level rises, fewer goods and services can be purchased per currency unit. That is, inflation is associated with a decline in the purchasing power of money.

Understanding inflation

Consumers tend to spend more money on products and services when an economy grows. So long as the economy is on its growth cycle, demand for goods will always outweigh the supply of the same, causing producers to increase the prices charged for the products, and this, in turn, causes inflation.

As prices rise, fewer goods and services can be purchased with a higher amount of money. The general public’s cost of living is affected by this loss of purchasing power, which ultimately slows economic growth. As per most experts’ consensus, sustained inflation happens when a country’s money supply expands faster than its economy.

It is essential to understand that inflation can be moderate, which signals economic growth, whereas if the inflation is extremely high, it signals an unsustainable economy.

Knowing the changes in prices of an individual product over time is easy. However, you cannot use a single product to measure inflation. There must be an impact on the changes in prices of various classes of goods and services for a period to know the rate of inflation. This is at least because humans need more than a single product or a service to survive and lead a comfortable life.

Causes of inflation

The leading cause of inflation in an economy is increased money supply chasing after a few goods and services. In many instances, the increased cost of producing goods or excess demand for goods and services is the main driver for increased money supply.

However, monetary authorities in a country can also play a role in inflation and cause money to lose its purchasing power by:

- Printing additional currency and distributing it to people.

- Devaluing the legal tender currency, though legally.

- Acquiring government bonds from banks on the secondary market to create new money as reserve account credits through the banking system.

In all the situations described above, money loses its purchasing power. The instruments of how this causes inflation made it possible to distinguish three types of inflation in economics, which we discuss below.

1. Demand-pull inflation

The first type of inflation is often caused by the consumers’ extreme need for goods and services. This is because consumers have too much money, which increases their desire to spend excessively. This situation occurs because the production of goods and services occurs at a lower rate compared to the money supply and credit in the economy. Therefore, an increase in demand for goods or services initiates an increment in their prices.

2. Cost-push inflation

This inflation occurs when the cost of raw materials or inputs and wages increase, causing an upward movement in the general prices of goods and services. In some instances, it is referred to as wage-push inflation.

When the cost of inputs increases, production becomes costly, leading to a decrease in the number of goods produced, hence, a reduction in the aggregate supply in the economy.

Since consumers need these goods, producers push the increased production costs on them. That is, cost-push inflation mainly occurs when consumers’ demand for a particular product remains constant when the price of its production increases.

3. Built-in inflation

As prices rise, people can expect the current inflation rate to continue. Because of this, employees may demand higher salaries to continue to maintain their usual lifestyle. If wages rise, the cost of goods and services also rises, and the wage-price spiral does not break, as one causes the other, and vice versa.

Types of price indexes

A price index is the normalized mean of price comparisons for a specific class of goods or services in a particular location over a specific period. It is a statistic created to assist in comparing how these price relatives, when considered collectively, vary over time or across geographic regions.

There are different types of prices indexes, but the most used are:

- Consumer Price Index (CPI).

- Wholesale Price Index (WPI).

- Producer Price Index (PPI).

Let us see how each one works.

1. Consumer Price Index (CPI)

The meaning of the consumer price index is to track changes in retail prices, which is vital for determining the rate of inflation in the economy. CPI is one of the most crucial economic statistics. It provides an idea of how much things cost, accounting for the average cost of living.

CPI tracks the average price change paid by urban consumers over time for a market basket of the most important consumer goods and services, such as food and medical care.

The CPI is estimated using a very rigorous calculation. Still, the simplest way to derive it is by averaging price changes for each item in a predetermined basket based on their relative weight in the overall basket.

The prices that are taken into account are the retail prices of each item as they are available to be purchased by everyday citizens. Numerous categories and subcategories have been created to classify consumption items based on consumer types like urban or rural.

2. Wholesale Price Index

A wholesale price index (WPI) measures changes in the overall price of goods prior to their retail sale, and this includes the costs charged by producers or manufacturers. The WPI is an inflation indicator usually expressed as a percentage change from the previous month or a year ago.

Most countries use this index to calculate inflation or deflation, unlike the United States, which uses the Producer Price Index to measure the same.

3. Producer Price Index (PPI)

PPI tracks the standard change in selling prices domestic producers receive for their output over time. The prices in the PPI come from the initial commercial transaction for many goods and some services,

The difference between CPI and PPI is that the PPI measures price changes from the seller’s perspective, while the CPI measures price changes from the buyer’s perspective. In all differences, the price increase of one component may partially offset the price decrease of another.

The formula for measuring inflation

You can use the above indices to determine the value of inflation between two specific periods. Although there are many online inflation calculators, it is essential to understand the underlying methodology.

Let’s look at the steps to get the percentage inflation rate for two periods.

1. Get the data

Understand the product you wish to evaluate, then gather its price information during a period of your choice. You can research the product or get the information from your country’s Bureau of statistics.

2. Present the gathered information on a chart

Create an easy-to-read chart with the data you have gathered. The averages are calculated on a monthly and annual basis, so your chart might include that information.

3. Determine the period

Choose how far into the past or future you want to go. The data can also be calculated over specified months, years, or decades. To figure out how much you need to save, you might try to predict inflation rates for the time when you retire. On the other hand, you might be interested in the inflation rate over the last ten years or since you graduated.

4. Find the CPI for a previous date.

Find the CPI for the product or service you are analyzing on your data chart or one from the bureau as your starting point.

5. Choose a CPI for the later date

Locate the CPI for a later date, typically the current year or month, while continuing to focus on the same good or service.

6. Work out using the inflation rate formula

Subtract the previous date’s CPI from the current date’s CPI and divide the result by the earlier date’s CPI, then multiply the results by 100. The answer is the inflation rate expressed as a percentage.

Here is the formula:

% Inflation rate = Current date CPI – Previous date CPI * 100

Let’s try to calculate retail inflation. For instance, a kilogram of sugar in India was Rs.8 in 2012 and cost Rs.12.5 in 2022. So, Rs.12.5-Rs.8 equals Rs.4.5. Divide Rs.4.5 by Rs.8, then multiply the result by 100 you will get 56.25%. Meaning the inflation rate in India for the last 10 years on a kilogram of sugar between 2012 and 2022 was 56.25%.

Advantages and disadvantages of inflation

Inflation carries both good and bad sides.

Advantages

The main advantages of inflation include the following:

- Employers can adjust wages

No employees would wish or negotiate for a decrease in their salaries. When inflation is moderate, the average wages for employees increase so that they can cope with the rising increase in the prices of products and services. Inflation is one way employers can increase the wages for their productive workers while freezing the salaries for the unproductive ones.

- Foreseen higher profits

People who own tangible assets such as real estate or stocked commodities valued in their home currency may prefer to see some inflation because it will increase the value of their possessions, which they can then sell for more money.

- Encourages all levels of spending

Debtors benefit from inflation because they can repay their loans with less valuable funds than the funds they borrowed. This promotes borrowing and lending, which also boosts spending on all levels.

- Increased output/production

Inflation is thought to boost output when the economy is not operating at total capacity, which means there is unsold labor or untapped resources. Spending increases when there are more funds available, which boosts aggregate demand. To meet it, production must increase.

- An advantage to capital market investors

Inflation frequently leads to businesses speculating on risky projects and individuals investing in securities because they expect higher returns than inflation.

Disadvantages

There are several significant disadvantages of inflation:

- It increases the cost of living

It goes without saying that as the cost of goods rises, consumers will have to pay more for both necessities and luxuries. This may not be a problem if income increases in line with inflation, but those whose wages do not rise will face higher real prices. In other words, they will be required to spend a greater proportion of their earnings on the same quantity of goods.

- Increases inequality

One of the implications of inflation is that asset prices rise. Housing, the share market, and commodities like gold tend to outperform inflation.

This raises inequality because wealthier households have more assets. They own more real estate, stocks, and other assets. This means that when inflation occurs, the price of these assets rises before the cost of everyday goods like bread and milk. As a result, they end up with more money to spend on products than they did before. Simultaneously, low-income households must spend more just to get by.

- It discourages long-term economic growth and investment

Low inflation is thought to promote greater stability and encourage businesses to take risks and invest. This is due to the increased uncertainty and confusion during periods of high inflation.

Controlling inflation

The two main ways inflation can be controlled are monetary policies by the government and/or the central bank and fiscal policies.

Monetary policies

The central bank increasing the interest rates which will have the following effects:

- Borrowing becomes expensive, and this encourages saving.

- Mortgage payments increase, leading to less disposable income to spend.

- Firms will be blocked from borrowing and may not adequately fund investments, hence a lower economic growth rate.

- Increases the exchange rates, which will reduce inflationary pressure by:

- Cheapening imports.

- Lowering overall demand in the economy by reducing demand for exports.

- Motivation for exporting businesses to reduce costs and boost competitiveness over time because exports are less competitive than imports.

Fiscal policy

The government can cut spending and raise taxes, such as income tax and VAT, to lower inflation. These measures help to reduce demand in the economy and improve the government’s budget situation by slowing the expansion of the overall demand.

If the economy is expanding quickly, slowing down aggregate demand growth can lower inflationary pressures without triggering a recession. However, raising taxes to combat inflation is politically unpopular, which is why fiscal policy is rarely used to control inflation.

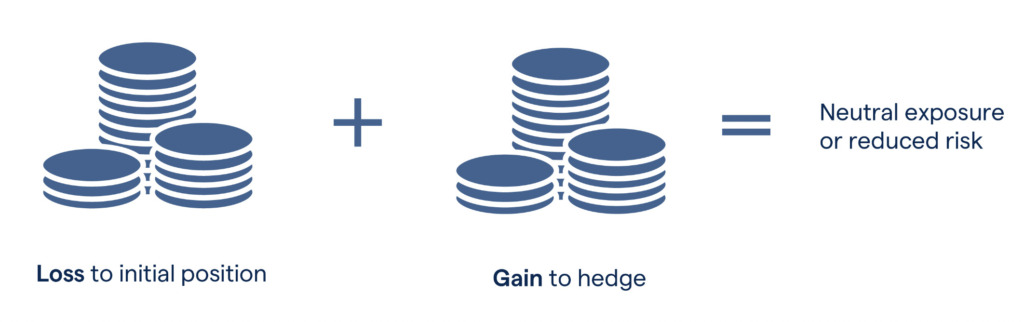

Hedging against inflation

Hedging against inflation is investing in assets that are thought to protect a currency’s purchasing power from a loss of value due to rising prices, which can be macroeconomically or due to inflation. Some of the ways to hedge inflation include:

1. Investing in stocks

When stock prices rise, the effects of inflation are always included; hence, stocks are considered the best hedge against it. Also, because bank credit injections through the financial system are how virtually all modern economies increase the money supply, a large portion of the immediate impact on prices occurs in financial assets valued in their home currencies, such as stocks.

2. Try Treasury Inflation-Protected Securities (TIPS)

TIPS are a category of United States Treasury bonds that is designed to rise in value in tandem with inflation. Because they are backed by the federal government of the US, they are regarded as among the safest investments in the world.

TIPS applies the adjusted principal to a fixed rate of interest that is paid twice a year. When there is inflation, the principal increases, and when there is deflation, it decreases.

3. Invest in real estate

Investing in Real Estate has a lot of benefits. This asset class offers stable income through dividends and has intrinsic value. Due to the constant demand for homes, regardless of the state of the economy, and the fact that as inflation increases, so do property values and rental rates, it frequently serves as a good inflation hedge.

Extreme examples of inflation

The worst case of hyperinflation in history occurred in Hungary between 1945 and 1946. The Hungarian peng currency declined as a result of loose monetary policy.

The Hungarian government started printing money. To reduce the number of zeros and simplify calculations, 1 million peng and 1 billion peng denominations were introduced.

Prices doubled in just a day. In 1946, the forint, a new currency, was introduced, and the streets were filled with old peng.

Another country that experienced hyperinflation was Germany which was forced to pay reparations in gold or foreign currency. The Reparations Commission refused to accept German Papermarks, or “marks,” which were quickly losing value as a result of the German government’s misleading monetary policy.

Germany employed a strategy to print large amounts of marks and then use them to buy foreign currency. Hyperinflation began in August 1921, when Germany started buying foreign currency for any amount of marks. The exchange rate continued to fall, requiring more and more Marks to purchase foreign currency, and thus more and more Marks were printed.

It reached a point that the marks in circulation were so many that they had to be transported in large sacks or even wheelbarrows.

What is the inflation rate in India?

Since 1960, inflation in India has been increasing steadily, with an average rate of 7.5% per year. As of August 2022, the inflation rate was 5.9% which is an increase of 0.8% from 2021.

If forecasting for the next 20 years, the inflation rate in India is expected to rise. 411 Indian Rupees will equal the purchasing power of around 741 Indian rupees. This will happen if the Indian rupee has an inflation rate of 3% per annum until 2042.

What causes inflation?

Inflation can be caused by any of these three:

- Demand-pull: Consumers’ demand for specific goods becomes too high than producers can produce, leading to increased prices.

- Cost-push: The cost of producing goods or services becomes too high, forcing producers to shift the cost to consumers by increasing the price.

- Built-in: This type of inflation happens when workers fail to meet the increased prices of goods and services, forcing them to demand increased salaries. So, the business also raises the prices of goods to offset the rising wage costs.

Is inflation good or bad?

Inflation is neither good nor bad. It is bad when its rate goes too high or too low. Many economists support a middle-ground inflation rate of 2% per year or less, which they consider low to moderate.

While high inflation can be detrimental, too little inflation can also harm the economy. When this happens, the Central bank lowers interest rates or buys assets to increase money circulation to make borrowing money easier for people and to stimulate economic activity.

What are the effects of inflation?

Inflation’s most pervasive and primary impact is eroding the consumer’s purchasing power. Over time, a general price increase reduces purchasing power because a fixed amount of money allows for progressively less consumption. Consumers lose purchasing power regardless of whether inflation is 2% or 4%, but the higher the rate, the faster they lose it.

Inflationary pressures discourage saving because they erode the purchasing power of savings over time. This possibility can entice consumers to spend and corporate entities to invest.

Also, some commodities, such as real estate and collectibles, increase in pricing during inflation. While inflation reduces the real cost of fixed-rate mortgages, landlords can offset this loss by raising rents.

Why is inflation so high right now?

The current high rate of inflation can be attributed to several factors. First is a pandemic that began in 2020. Due to lockdowns at its beginning, consumers started spending less and saving more money. People then started making larger purchases once the restrictions were lifted.

Companies, however, were unable to meet this increased demand from customers because many of them had to reduce production, which resulted in shipping delays, labor shortages, and a lack of essential inputs. The result of this is, of course, higher costs for the majority of goods and services.

Inflation picked up in 2022 as fuel, and a host of other goods from Russia came in limited quantities.

The bottom line

The rising prices of goods and services are normal and should not cause an alarm because it is for the economy’s good, unless in extreme cases. So long as the monetary authorities in a country can control inflation, it should work for the development of the economy and not harm consumers.