The term “falling knife” is adopted by traders to denote a sudden fall in the price of a security or underlying asset. The term is commonly used in phrases like “do not attempt to catch a falling knife,” implying that you wait until you reach the bottom before buying. This situation has two fates: A knife falling can rapidly rebound in a whipsaw, or the asset may lose its entire value in bankruptcy. Investors often deploy this trading method as a preventive measure to jump into the market before it drops. Let’s examine the falling knife and how beginner traders can maximize this knowledge to increase their chances of making a profitable trade.

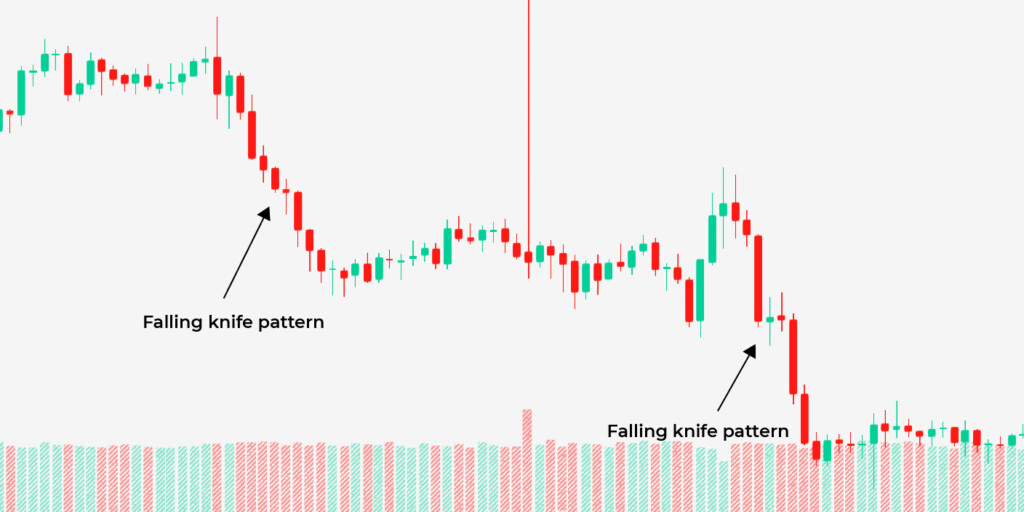

What a falling knife pattern looks like

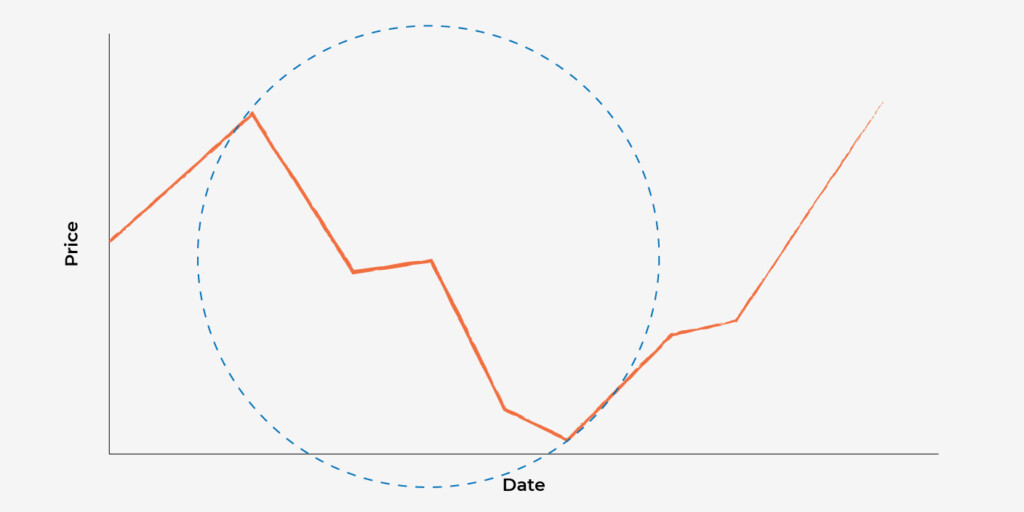

The pattern of a falling knife usually forms a sharp downward price movement on the trading chart. This downward price inclination often moves without a pause or consolidation. As you will see below, a falling knife is formed by a series of bearish candlesticks.

The second chart demonstrates the danger of trying to speculate the price bottom.

In this example, the trade forms a falling knife after moving away from its 50-day moving average. Traders trying to catch this falling knife may place a buy order somewhere around $8.5 but would have lost part of their investment as the price moves below to around $6.0 before bottoming.

What are the causes behind a falling knife?

One important question you might want to ask is, “what are the possible causes behind a falling knife?” You would notice a falling knife pattern on your price chart for a few reasons. Here are a few explanations for it:

1. Company’s financial report

There is a direct connection between the announcement of a company’s financial report and a volatile swing in its prices. If they have a low financial report, the prices may form a falling knife until equilibrium is reached in such a market.

2. Economic reports

Well-recognized indexes are mostly affected by economic reports such as FOMC meetings or employment reports. If any of these reports are negative, stocks can move lower as a response.

3. Technical Breakdown

As you would imagine, some falling knife patterns occur due to technical factors rather than fundamental ones. If a traded asset breaks from a support level, the price may move sharply downward in search of another support level.

4. Equity

When there is a pressing need for a company to raise capital, the process may incur additional public shares. It would often dilute the company’s current shareholders, fostering a sell-off.

How to invest when there is a falling knife

It is naturally risky to consider an investment with a falling knife, but it could bring good returns when properly executed. First, it requires a lot of patience, market intuition, skill, and discipline.

Check out some investment tips with the falling knife strategy without getting your hands bloody:

1. Trade with technical analysis

Your technical trading skill should help you watch out for the following trading signals:

—When the asset price reaches a new low

—When there is an extreme increase in volume and

—The asset is likely to stay the same when there are traces of trend reversal or price recovery.

2. Keep an eye out for the dead cat bounce.

The dead cat bounce is when there is a rapid fall in a stock price, but then it reverses and starts an uptrend. However, this high movement is usually temporary, which can be a setup for investors to start buying, thinking the price has found a bottom.

3. Trade with a stop-loss

A stop-loss order will help you to mitigate the risk of exposing your portfolio to unprecedented consequences. A stop-loss order will ensure you do not lose more than you can bear if the asset continues to fall.

Limitations of the falling knife strategy

No trading strategy doesn’t have its limitations. One of the known limitations of the falling knife strategy is that it can be difficult for traders to have perfect timing of the price bottom (i.e., the lowest price an asset will fall to before moving up). There is no ultimate guarantee that the price will continue to fall, even after identifying all possible criteria of a falling knife stock. This is why it is crucial to always trade with a stop-loss order when using this strategy.

Another limitation of the falling knife strategy is that prices can take a long time before moving up. This can frustrate investors anticipating the price movement in a particular direction.

Concluding remarks

The falling knife can be a profitable method when timed properly. Traders must dedicate the time and attention needed to grasp this technique in the coming months fully. For long-term investment, buying a falling knife can be economically beneficial during the fall when you hold it for years.

Sources:

Investopedia: What Is a Falling Knife, and How Do Investors and Traders Use It?

CFI: Falling Knife

Phemex: What Is Falling Knife In Crypto Trading?