How do you identify significant trading opportunities in the global market? Many trading experts have a go-to wildcard that helps them erase a second guess when trading. Some prefer to test their strategies using trade simulators, while others are technically inclined to trading indicators.

Whatever the case is for you, we are here to clear your mind about what approach you should confidently face the global market with. Before proceeding, you must understand that the trade simulator and Zigzag indicator are distinct methods to identify trading opportunities. It is not in your best interest to discredit one for the other, as you will need all the help you can get from your trading journey.

The Zigzag indicator

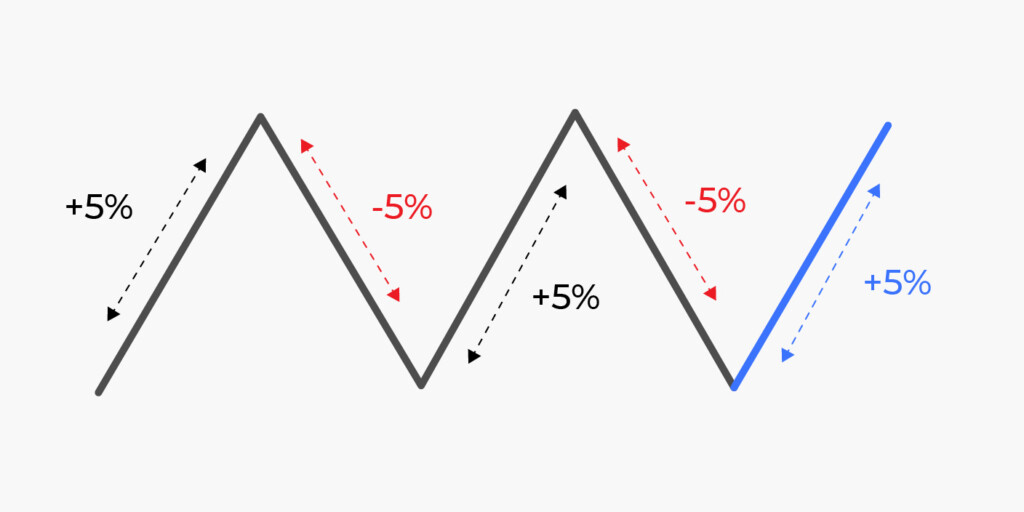

The zigzag trading indicator is considered to bring order to trading chaos. It is an indicator that can be given specific instructions to execute by drawing a Zigzag line across the area of execution. For example, you can assign education to the zigzag indicator to draw a line whenever there is a 5% decline or advance in the price of an underlying asset.

For the above illustration, the price Zigzag indicator will look like this:

In this case, a Zigzag line will be visible on the price chart when there is a 5% decline or advance in price. The above is just a sketch. Here is what it looks like on an actual chart below with the same 5% Zigzag indicator setting:

There are a few things to note when using the Zigzag indicator

- The trader can change the values of the indicator at any time

- The Zigzag indicator uses points instead of percentages

Trading simulator

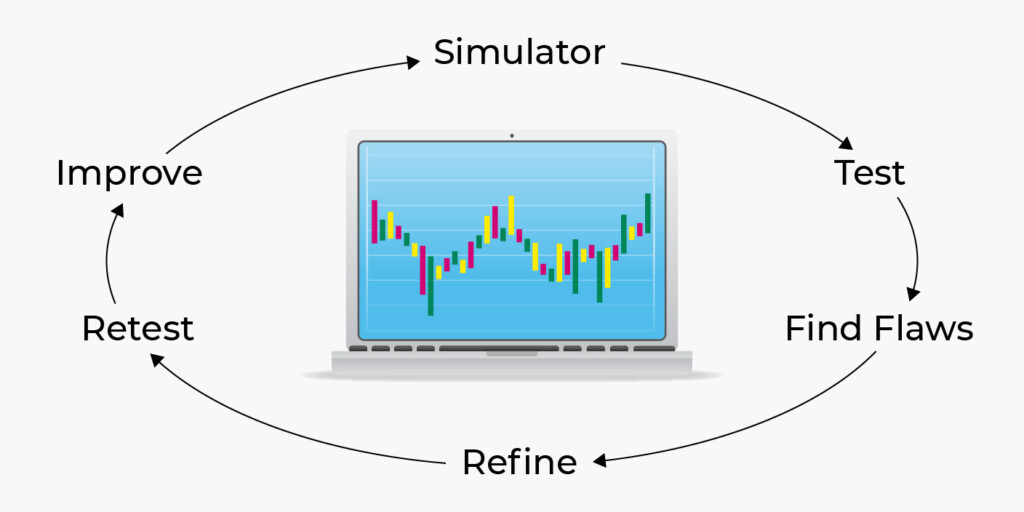

First-year traders are encouraged to use trading simulators to test their trading capabilities until they are confident enough to go live. The essence of trading simulators is to help you build trading experience as you master your craft. However, the results on a trading simulator are different from that of a real-life trade. A trading simulator is a go-to option for novices who need help comprehending the basics of trading indicators and would like to flex their muscles on new trading strategies.

When it comes to trading simulators, there are three main types, and the goal of each is to mimic a real trading environment:

- Paper trading

- Real-time simulators

- Replay simulators

Pros of zig-zag indicator

- The zigzag indicators help you to time your exits well

- With the zigzag indicator, you can better analyze your chart.

- The Zigzag indicator is an essential tool for mastering technical trading.

- You can define market structure easily with the Zigzag indicator

- It takes little time to implement.

Cons of zig-zag indicator

- You can only trade progressively declining or advancing market

- It does not assure effectiveness during sudden price movement

Pros of trading simulators

- It helps you to identify what strategy works

- You do not have to risk anything

- You can master how to trade a broad range of assets within a short period

Cons of trading simulators

- The trader is likely to be impatient

- You may get used to trading with unrealistic lot sizes

- Does not include trading psychology

Final verdict

As a global trader, you must identify what works best for you and how to utilize it for your profit. The Zigzag indicator is ideal for traders who want to go beyond the face value of trading. On the other hand, trading simulators are best for traders who would like to assess their trading strategies before launching out. Also, veteran traders recovering from a loss can utilize both methods to avoid future losses.

Sources:

Centerpoint: The Ultimate Guide to Trading Simulators

Investopedia: Zig Zag Indicator: Definition, How Pattern Is Used, and Formula

Trading with Rayner: The Ultimate Guide to Zigzag Indicator