Gaps are a simple concept. However, you should know how they work. Some of them get filled within a short period. According to statistics, there is a 91.4% probability the gap will be filled. What does it mean for your trading? Keep reading to answer this question.

What are trading gaps?

If you look at the chart below, you will notice that the open price of every candlestick is within the body of the previous candle or at least at the same level as the last close price.

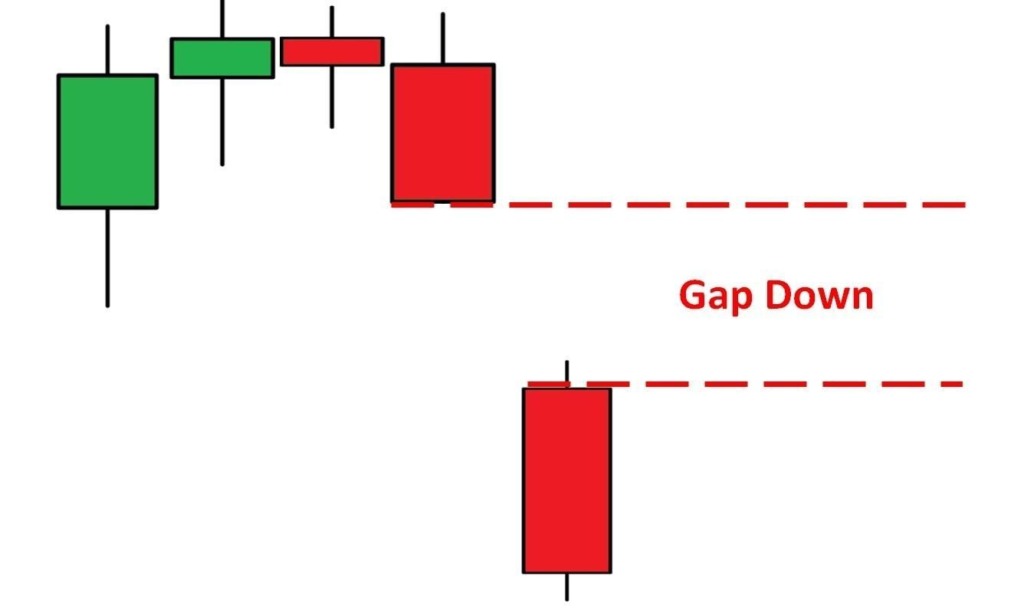

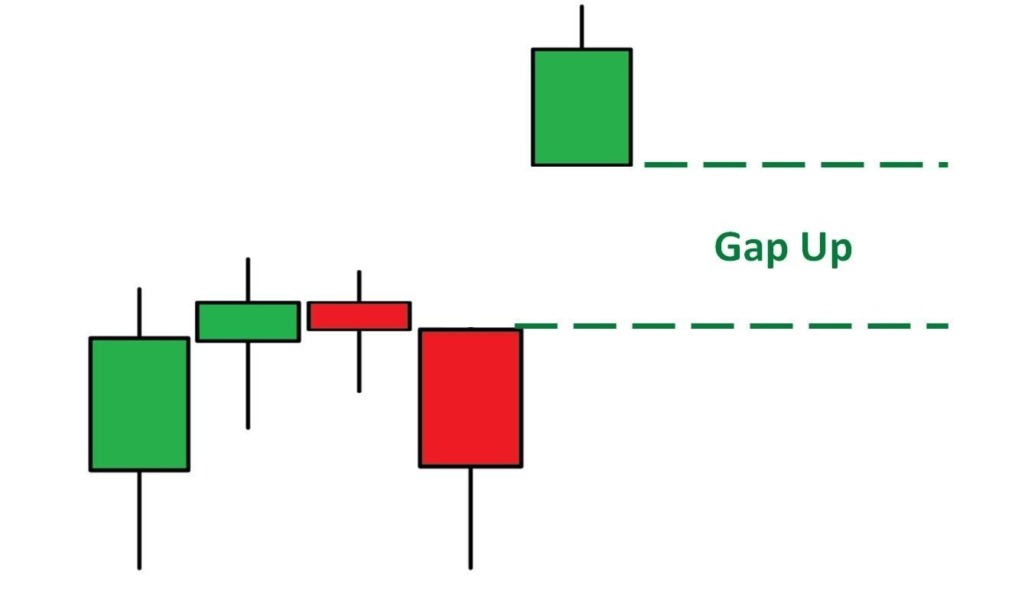

However, this is not always the case. Sometimes, the open price of a candle is formed far below or above the previous candle. Thus, there is a space between them. This space is called a gap or a window.

There can be a partial gap and a full gap. The partial one occurs when the open price is below or above the previous candle’s close price but is still within the price range of the last candle—remember, there are shadows that determine how volatile the price is. The full gap is when a candle’s open price isn’t within the previous candle’s range.

Trading gaps can appear on a chart of any asset. Therefore, there can be trading gaps in Forex, stocks, commodities, cryptocurrencies, etc.

When do gaps occur?

Gaps usually appear on a price chart when there is an unexpected event or an unexpected outcome of an event—or if the market is barely liquid. A gap can be called an overreaction of a market to an event. Therefore, it usually occurs on the next day or after the weekend. Day trading gaps are rare; you can find them only on illiquid markets.

Types of trading gaps

There are some gap classifications. The first one is based on a gap’s direction. If the open price of a candlestick is below the lowest price of the previous candle, it’s a gap down. Vice versa, when the open price is above an earlier candle’s highest price, it’s a gap up.

Another classification is based on the behavior of traders. There can be common, breakaway, runaway, and exhaustion gaps.

1. Common gaps

Common gaps appear without reason. Therefore, they are usually filled rapidly. Here, we need to clarify. The gap is filled when a price returns to pre-gap levels. As there is no significant event behind common gaps, price movements are average.

2. Breakaway gaps

A breakaway gap is formed when the price opens either above a resistance level or below a support level. Such gaps often occur after reversal chart patterns.

3. Continuation or runaway gaps

Such gaps occur within a strong trend. They reflect that buyers in an uptrend or sellers in a downtrend are strong enough to drive a price further.

4. Exhaustion gaps

An exhaustion gap signals a price reversal. Although a price breaks above resistance or falls below support, it’s accompanied by low trading volume.

Forex trading gap strategy: swing trading

There are numerous strategies you can apply to gap trading. We will consider how to use gaps in swing trading.

Swing trading gaps

Swing trading is based on a price reversal. A price reversal can be determined with support and resistance levels. And an exhaustion gap can help you.

As it was mentioned above, the exhaustion gap is formed when a market is weak and traders don’t have the strength to drive the price further.

If you catch a gap close to support or resistance level, check price volume. If it’s high, it’s more likely it’s a continuation gap. If volumes are low, it’s an exhaustion gap that signals a price reversal. Place a buy order on a support level or a sell order on a resistance level.

What does a gap tell you?

A gap is a sign that there are changing conditions in the market, and that a particular asset was affected by a specific major event. There are different things that cause gaps, such as:

· Fed actions

Stocks and different other assets can usually have gaps caused by the Fed. Stocks can open lower or higher after a bank makes an emergency announcement.

· Investigation

Before the Justice Department launches a big investigation, some stocks can open sharply lower. Once the investigation reaches its end, the stocks can sometimes open higher.

· M&A deal

M&A deals can also lead to gaps. When someone buys a company, the stock price will rise in order to reach the premium price. Following the gap, there will be a consolidation period.

· Earnings

In this case, gaps occur when a firm publishes results during its earnings season. If the business publishes weak results, it will lead to a bearish gap. On the other hand, if it publishes strong results, it will lead to a bullish gap.

How to find gaps

Finding gaps is not that difficult. In order to detect them, you should look for pre-market movers. Firms in the pre-market movers’ list usually open with a large gap.

You can also find them if you look for businesses that are making headlines before the opening of the market. If you want to have an easier time finding them, you should consider subscribing to a free watch list.

Gap trading example

For instance, a gap can occur when a stock is $10 at the end of the day, then the next day it opens at $13. Many gaps occur on Mondays when the market opens.

If shares trade at $16.45 before the market closes, you can make a buy-stop trade at $17.67 and a sell-stop trade at $15. Then, you can use a trailing stop and a take-profit in order to protect your trades.

It’s important to know when to do gap trading. If you subscribe to a watch list, you should be able to find gaps and begin trading.

Takeaway

The concept of gap trading is quite simple. Gaps don’t often occur on liquid markets, but you can catch them after significant events. Remember the four major gap types, and you will be able to build numerous trading strategies.