The success rate of traders is usually low. Let’s be honest, trading is hard. Even though perseverance can play a significant role in the success of some, it is not always imminent.

People who are only in it for financial gain are less likely to find any fulfilment in the process. The reason is that the individual has to enjoy the process, not just chase profit!

Considering all these points and some trading system examples from various sources, we have curated a list of attributes for you to take into account. Let this article show you how to choose a trading system that fits your personality!

Personal risk tolerance

One excellent piece of advice that is quite common in the trade community is – the trading risk should never be more than 2% of the trader’s account in one particular trade.

The personal risk tolerance level of every trader may vary based on both their internal qualities and external contingencies. It may take some time and experience to figure out the level of risk tolerance of a broker.

To assess the level of personal risk, the trader can also open a small live account, instead of a demo account and trade Forex nano lots. Even a minimum contract size of $12.50 can eventually generate thousands of dollars per day!

Another way to calculate the personal risk tolerance level of a trader is to use the maximum drawdown prevention calculator. It can determine the level of risk a person can take per trade.

The perfect trading timeframe

Typically, the 3 timeframes associated with trading systems are:

- Swing Trading

- Day Training

- Long-Term Investing

Day trading occurs on the same day, whereas swing trading takes about two or more days to profit from a price change. On the contrary, long-term investing is going to take about a year to trade with bonds, assets, real estate, and stocks.

The right trading system for an individual highly depends on the personality, schedule, and technical know-how of that person.

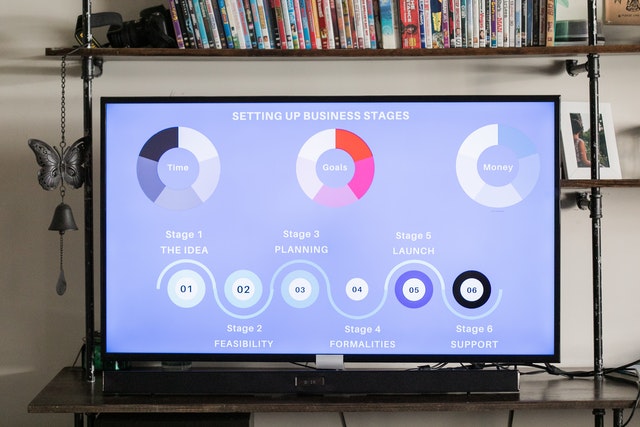

Trading setups

Your desired trading setup needs to be constructed by following chart patterns, observing trends, choosing trends, and sticking to them. Now, this can be divided into 2 major categories, such as:

- Fundamental Setup

- Technical Setup

Technical setups are used by professional traders to investigate and predict future price patterns. Mostly, indicators and charts are used to carry out these tasks. Some examples of technical setups are stochastic oscillators, moving averages, and other mathematical analyses.

On the other hand, the fundamental setup for trading systems and methods evaluates annual reports, economic data, and profitability index. The advice here is to master one of the two. Having mastered both is an added advantage.

If the trader chooses to conquer technical setup, it can be further broken down into these categories based on price fluctuation:

- Trend Patterns

- Breakout Patterns

- Countertrend Patterns

Frequency of trade

The trading frequency depends on what the trader can handle on a particular day or week. In reality, there is no right or wrong answer. High frequency of trade requires a strategic and slow decision-making process.

On the contrary, low frequency of trade needs the trader to make quick, instant decisions based on daily outcomes. This one here has to be executed without letting past outcomes influence today’s glory. Therefore, moping about past failures won’t work!

The advantage of the low-frequency trading methods is that holding time is minimized, training opportunities are high, and it is easier to compensate for losses.

Design of the win rate

To understand the win rate of the trading systems and methods, a few questions must be asked. Is it okay to have a lower reward/risk ratio? Or is the goal to have larger wins for lower win rates?

The harsh truth is that the trader can only choose one option from above (even though some people try to have them both!). For that very reason, you must pick the perfect win rate design to adjust profit and stop loss.

Current life situation

Trading systems must be approached based on the current life situation of the individual. It is impractical to start trading to pay basic bills if the trader’s savings is low.

The best strategy here is to save up enough to trade after a few more years. In the meantime, the individual can learn as much as possible about trading, and get some hands-on experience as well before going all out.

Usually, the early fifties are the most ideal time to start engaging in trading because most people have a decent savings balance. Even $100 in the trading account can whip up a large chunk of profit for the trader!

Furthermore, people in their forties or fifties with no family to support are in better positions to trade. These traders can engage in day tradings, increase their risks, and earn extra income faster than anybody else!

Getting close to picking the right trading system?

Mastering the art of trade takes effort, education, practice, and a lump sum of investment. Choosing the right trading system is part of education and practice. Hopefully, this article on how to choose a trading system that fits your personality has enabled us to shed some light on the reality of trading. Though it is not always hard, the beginnings can be tough, no doubt. But if you’re strategic enough, there’s always a way to profit from your trades!