Did you know that one of the earliest known forms of currency was cowry shells used in ancient India? They were small and durable seashells commonly found along the Indian Ocean coastline and used as a medium of exchange for thousands of years, dating back to as early as 6th century BCE.

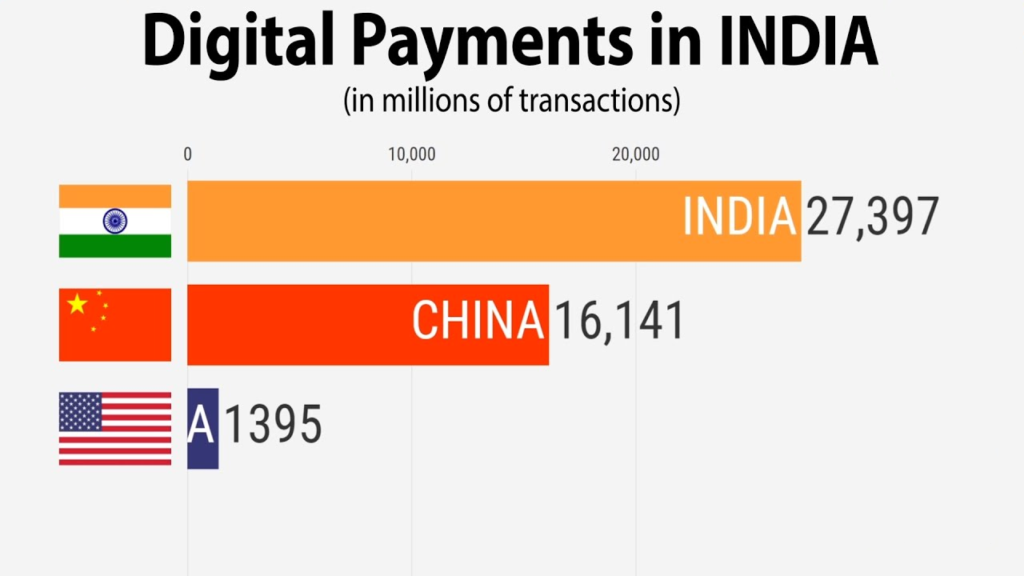

Now, with the digital payments revolution, the concept of currency has undergone a dramatic change. Let’s take a moment to reflect on the journey of currency and financial transactions and discover how it benefited consumers and businesses.

Historical perspective of payment systems in India

In ancient times, before the advent of currency, India relied on a barter system for trade. Goods and services were exchanged directly between individuals and communities based on mutual needs. Around the 6th century BCE, coins made of metals like silver, copper, and gold began to be used as a medium of exchange, followed by coins issued by various dynasties like the Mauryas, Guptas, and others.

The silver rupee, introduced by Sher Shah Suri in the 16th century, became the dominant currency and remained in use for several centuries. The British colonial administration introduced the British Indian Rupee in 1835, which became the official currency of India. After India gained independence in 1947, the Indian rupee continued as the national currency.

The late 1990s and early 2000s witnessed the growth of internet banking, allowing customers to perform various banking transactions online. And in the 2010s, companies like Paytm, Google Pay, PhonePe, and others introduced digital wallets and payment apps.

What’s driving the growth of digital payments?

India has an environment conducive to embracing digital payment methods, and here are some of the reasons why:

- Demonetization of all ₹500 and ₹1,000 banknotes of the Mahatma Gandhi Series to curb corruption, black money, and counterfeit currency

- Improved internet penetration

- Proliferation of smartphones

- Introduction of the Unified Payments Interface

- Growth of e-commerce

Moreover, India’s data traffic usage from 2017 to 2021 has been among the highest in the world (a CAGR of 53%), and it has played a crucial role in driving the growth of digital payments in the country.

The role of government and regulatory bodies

The Government of India has launched various campaigns and initiatives to promote digital payments across the country. Programs like Digital India and Jan-Dhan Yojana aimed to increase digital literacy and expand access to formal financial services for all sections of society. Besides, regulatory bodies like the Reserve Bank of India and the National Payments Corporation of India ensure the safety and security of digital transactions by setting standards and guidelines for payment providers and banks.

As for indirect impact, the government and regulators collaborate with industry stakeholders in the fintech sector. This encouraged the development of innovative payment technologies and services, effectively fostering a more diverse and advanced digital payments ecosystem.

Popular digital payment methods in India

Driven by technological advancements, government initiatives, and a growing internet-savvy population, India is increasingly using these payment modes:

- Banking cards

- USSD (Unstructured Supplementary Service Data)

- AEPS (Aadhaar Enabled Payment System, note: Aadhaar card is a unique identification number linked to demographic and biometric data)

- UPI (Unified Payments Interface)

- Mobile wallets

- Banks prepaid cards

- Point of Sale (POS) machines

- Internet and mobile banking

As India continues to embrace digital payments, more innovations and integrations are likely to emerge and will further simplify the financial ecosystem. Plus, online trading platforms like Binomo signify the broader trend of technology-driven advancements in financial services. So, cash is quickly falling out of favor.

Advantages of digital payments for consumers and businesses

Even though cashless payment systems aren’t perfect and present challenges in adoption and implementation, the undeniable upsides far outweigh these concerns. Advantages for consumers:

- Easy and quick transactions from anywhere

- Clear electronic trail for budgeting

- Cashback and benefits from using digital platforms

- Access to banking services for all

For businesses:

- Speedy processing improves cash flow

- Reduced cash handling expenses

- Expands customer base and online reach

- Enhanced service with cashless options

- Analytics for informed decision-making

- Facilitates cross-border transactions

In conclusion, the country’s journey from cash-dependent transactions to the digital frontier has been both remarkable and inspiring, but the true potential of this revolution is yet to be fully realized. With a massive population and a rapidly expanding internet user base, India stands at the cusp of another digital payments revolution. This time, it will be an even bigger catalyst for social progress and economic empowerment.

Sources:

A digital payments revolution in India, The Economist

How India’s Central Bank helped spur a digital payments boom, International Monetary Fund