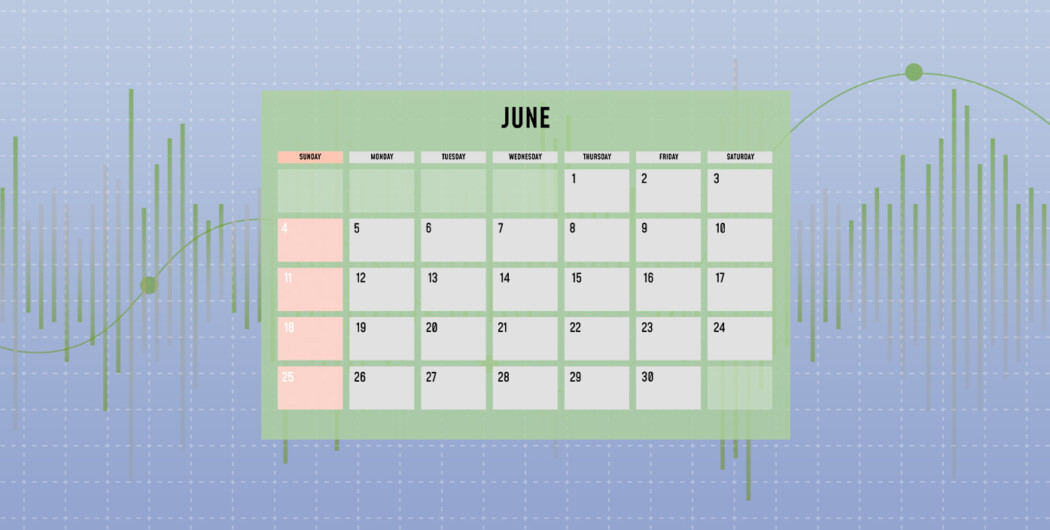

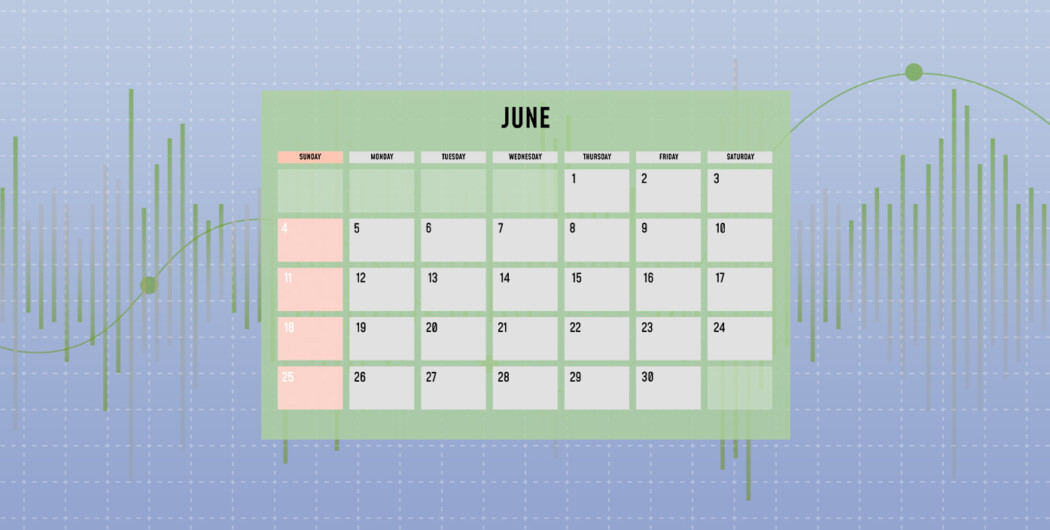

June 2, 12:30 GMT: Nonfarm Payrolls

Nonfarm payrolls data reflects the number of new jobs created in all non-agricultural businesses in the United States for the previous month.

Traders closely follow the release as the number of new jobs is one of the basic metrics the Federal Reserve considers when analyzing the country’s economic performance and implementing monetary policy tools. Every release causes increased market volatility, especially in the major pairs. A growth of the number of new jobs usually pushes the US dollar up, while a decrease negatively affects the US domestic currency.

June 6, 4:30 GMT: RBA Interest Rate Decision and Rate Statement

On June 6, the Reserve Bank of Australia will announce its interest rate decision. The central bank meeting is always an important event for the markets as it maintains the country’s economic conditions.

The RBA kept the interest rate unchanged from December 2020 until April 2022. However, enormous inflation made the bank turn to a hawkish monetary policy. The RBA may continue raising rates if the inflation does not meet the target. Usually, when the central bank raises the interest rate, it positively affects the Australian dollar. The market will evaluate other economic factors if the rate is on hold.

June 14, 18:00 GMT: Fed Interest Rate Decision

18:30 GMT: FOMC Press Conference

When the Federal Reserve releases its interest rate decision, traders consider not only the rate but the Federal Open Market Committee (FOMC) decisions. Usually, when the bank raises interest rates, the US dollar rises, while when the bank cuts the rates, the greenback declines. Additionally, the FOMC Press Conference brings more volatility in the market as the Committee provides clues on the future monetary policy.

The Fed is expected to put rate hikes on hold but the situation may change if the economic conditions worsen.

June 15, 12:15 GMT: ECB Monetary Policy Decision Statement

On June 15, the European Central Bank (ECB) will announce its interest rate decision with a short statement explaining it. The interest rate decision is crucial for the Euro area as it reflects the stability of the EU economy. Keeping the interest rate at 0 from 2016, the ECB had to raise the rate in July 2022 to fight the rising inflation. Although the world’s central banks seem to pause the continuous rate hikes, the economy is still unstable, and the ECB can return to its hawkish stance. The rate increase will support the Euro but will signal new problems in the euro area.

June 22, 11:00 GMT, BOE Interest Rate Decision

On June 22, the Bank of England (BOE) will announce its interest rate decision, reflecting the country’s economic health. The BOE kept the rate on hold from March 2020 to December 2021 but worsened market conditions made it tighten the monetary policy. The central bank may stick to its hawkish approach if the metrics don’t reflect the stabilization of the country’s economy. Usually, an increase in the rate pushes the domestic currency up.