Anyone can be a trader, right? But to be a good trader, you need patience and a killer strategy. Many traders end up quitting after their first couple of months of trading because they don’t see enough of a profit.

So, how do you survive as a trader? Well, you need to hold out and stick to it longer than the people who drop out. And for that, we’re going to give you the best trader’s survival kit to use.

Start off with the basics

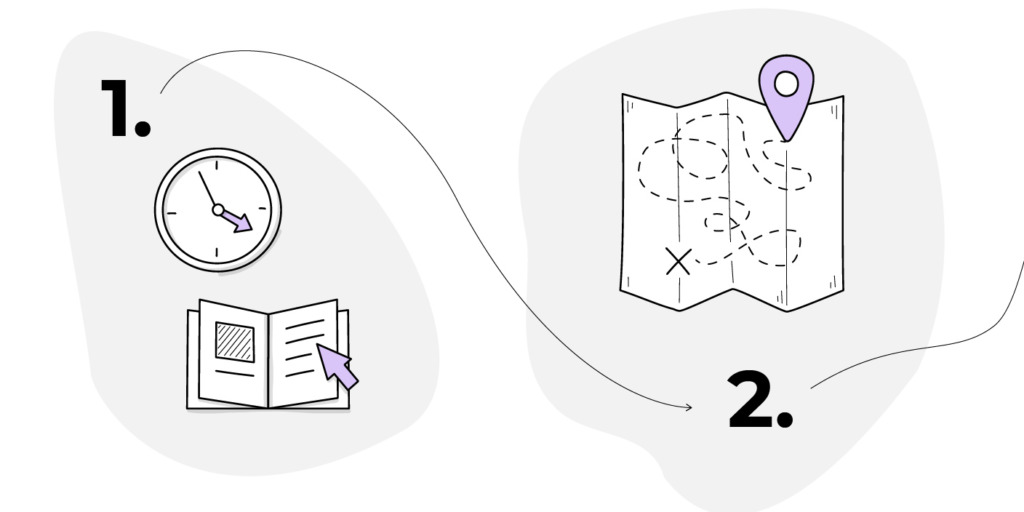

A lot of the time, traders get too invested in mastering the complications of the trade rather than the basics. If you don’t know the very fundamentals, you’re inevitably going to fall into a loop of losses and won’t be able to recover from that.

Knowing the basics means you’re able to find out where you made a mistake and gain experience from that. This is very helpful since it prevents you from making the same mistake again.

Trading requires immense discipline and patience. You can’t start off and just expect to know everything. You’ve got to treat it with the respect of a business and invest your time into learning the ins and out. In trading, or any business really, the more knowledge you have, the better you’re going to do.

You might not even make any money in your first couple of months trading. But that doesn’t mean you should give up. The entire process requires you to learn the trends, analyse your previous mistakes, and gain more knowledge along the way.

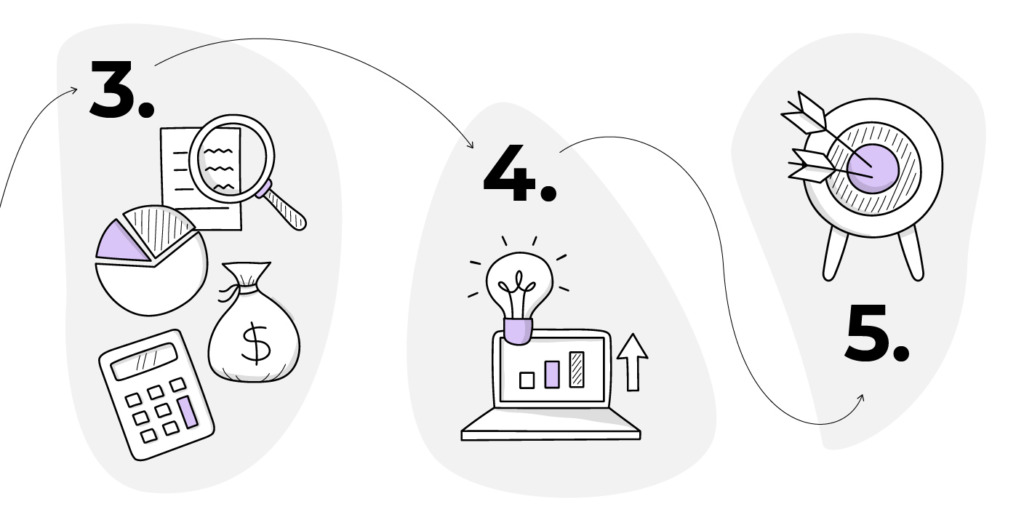

Set realistic expectations

You can’t expect to start trading today and hit big tomorrow. You’re going to make a lot of mistakes along the way and have a lot of losses. Learning to deal with loss is also an important part of trading.

If you aren’t realistic about what you’re expecting from trading, you’re eventually going to burn through money that you don’t have.

Thinking that changing your system is going to bring you profit is another mistake a lot of traders make. Create one strategy and stick to that. Learning new systems and methods is great but unless you know the basics, the best system in the world isn’t going to bring you enough cash to cover your losses.

Manage your bankroll properly

Diving into a trade and cashing out every last dollar you have is a bad idea for obvious reasons. Don’t spend money you saved up for your tuition, your wedding, or for your future child. Since that defeats the whole purpose of trading anyways.

You need to look at it from a business perspective. This is supposed to be a profession or a side job that brings in cash in exchange for your investments. If you’re having to dish out all of your cash now, what’s your backup plan?

Don’t get us wrong, taking risks is a great thing. But they need to be calculated risks. Don’t just take a risk because someone making a profit told you to do so.

And all of that is why you need to set a limit on how much you spend. This prevents you from losing too much money and forces you to take breaks once in a while.

Use the right tools

There are thousands of indicators and analytic tools out there at the disposal of every trader. If you’re going to use one, learn the proper application methods first. Just looking at the trends and making assumptions might give you short-term gains but the end goal would be losing a bunch of cash.

When you have a strategy or a system, give it time. If you’ve worked on developing the system for a while, chances are it’ll work in some way or the other. Jumping from strategy to strategy is never going to bring you long-term gains and it just deprives you of the experience you could’ve gained otherwise.

Focus on one thing at a time

We’re going to emphasize this again and again; you should delve into the knowledge of basics before you start trading. If you want to make money, you need a solid strategy that won’t fail you.

So, when you start learning a method, invest all of your time into learning just that. Don’t get side-tracked by those “learn to trade in 2 weeks” articles. It’s not possible to learn something like this in two weeks and do good at it.

Once you’ve learned the method and have created a strategy, stick to it. Don’t change your strategy midway through just because you’ve incurred a couple of losses.

Wrapping up

That’s it from us. We’d like to give a final piece of advice to all the aspiring traders; don’t get disheartened if you don’t get the profits you wanted. Trading is a difficult and arduous thing, but once you get the hang of it, your profits will be worth it.